Determining executive compensation is one of the most significant judgments for any board. It is the board’s responsibility, rather than management’s, to establish guidelines and approve a performance-based remuneration package that attracts and retains talented individuals while safeguarding shareholder value and corporate reputation.

Executive compensation represents a crucial element of corporate governance. The board, particularly its compensation committee, holds a pivotal role in ensuring that the remuneration provided to CEOs and other executives aligns with shareholder interests, supports the company’s strategic objectives, and adheres to public, cultural, and regulatory standards. With increasing calls for transparency and fairness, understanding how boards address this complex issue is essential.

When executed effectively, well-crafted compensation plans can mitigate the inherent ‘agency cost’ associated with delegating company management. Conversely, if managed poorly, such plans can increase risks, erode trust, and potentially result in directors losing their positions.

Setting the Foundation: Pay-for-Performance

Board responsibility in executive compensation focuses on aligning pay with performance to ensure rewards reflect company success, shareholder returns, and long-term strategic goals. The board’s compensation committee is responsible for designing, approving, and monitoring CEO and executive remuneration packages, often utilizing independent consultants to benchmark these packages against industry standards. Executive compensation generally comprises:

- Base Pay: A fixed, guaranteed amount.

- Annual Bonus: A short-term incentive based on performance.

- Long-Term Incentives (LTI): Stock options or performance shares.

Furthermore, boards are expected to critically evaluate the calibration of goals and the potential ease with which executives can exceed these targets.

Adapting to Market Realities

The board must revise compensation packages in response to market changes, such as economic disruptions or global events like COVID-19. They may need to modify targets, re-evaluate incentives, or offer relief measures to sustain morale and leadership stability.

Additionally, boards should act when talent markets become competitive. In 2024, several tech companies increased equity grants for AI roles to match start-up valuations, ensuring dilution was within shareholder-approved limits.

Shareholder Oversight and “Say on Pay”

Boards are increasingly being held accountable by shareholders, particularly with the introduction of “say on pay” votes. Although these votes are generally non-binding, they convey a strong message to the board regarding investor sentiment. Should a significant portion of shareholders oppose an executive compensation package, the board is expected to reconsider and possibly adjust its approach.

Managing Public Perception and Media Impact

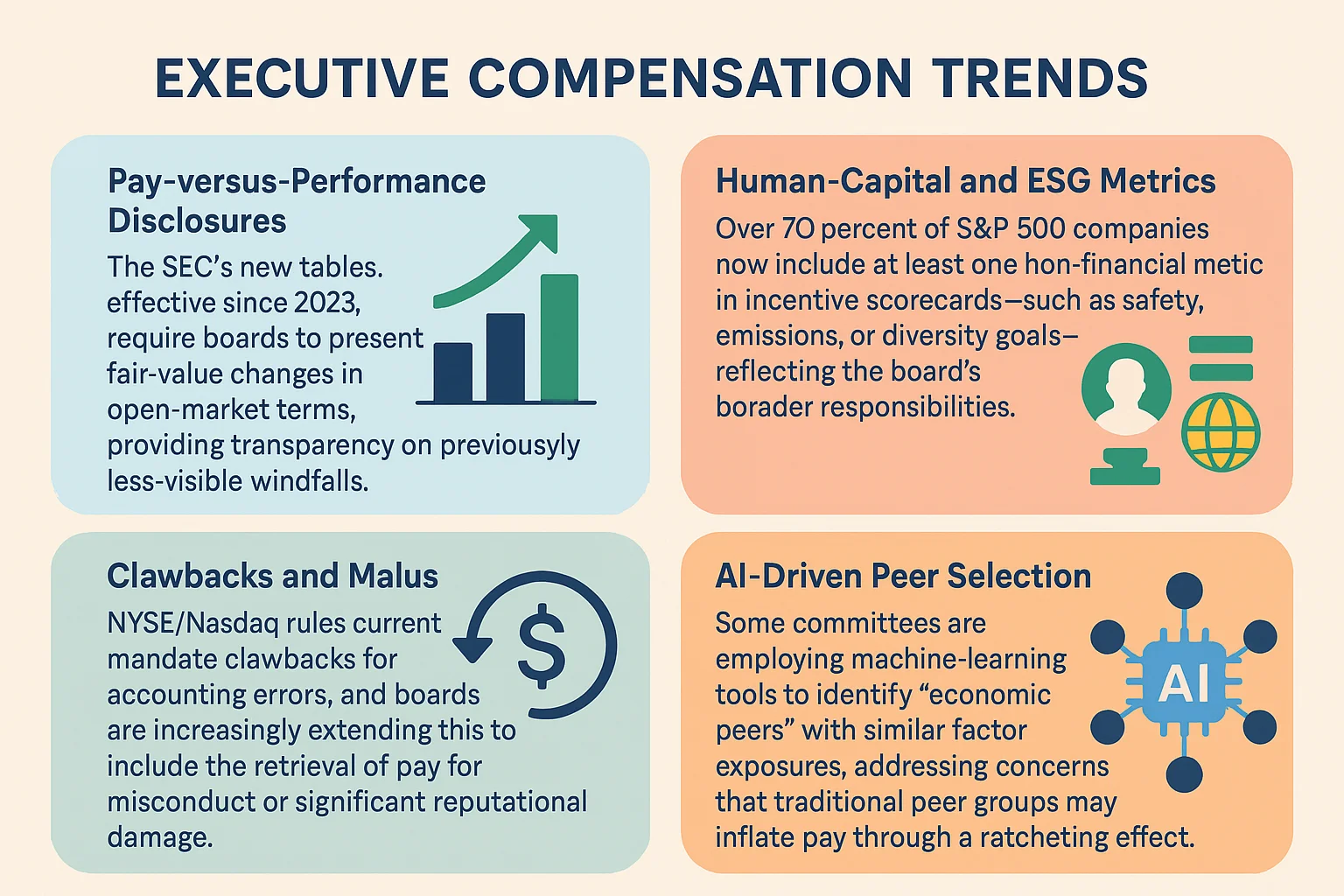

Media narratives significantly impact public opinion on executive compensation, affecting board decisions. Headlines often highlight total remuneration without context, misrepresenting pay packages and causing dissatisfaction. Boards must manage public opinion, where details are often overlooked. Stock-option values are reported as if fully realized immediately. To mitigate narrative risks, boards should provide clear explanations of equity valuation, disclose clawback triggers, and link awards to ESG metrics that appeal to more stakeholders.

Cultural and Regional Considerations

Compensation strategies differ globally due to cultural norms and governance structures. In the U.S., CEO compensation can be over 300 times the average employee salary, with 73% in bonuses and long-term incentives, prioritizing performance and shareholder returns.

In Japan, around 70-71% of executive pay is base salary, reflecting a focus on stability and collective responsibility. This influences behavior: U.S. CEOs aim for share-price spikes, while Japanese executives emphasize incremental, long-term value creation.

Boards must balance local compensation norms with global coherence, despite cross-border shareholder expectations.

Our Thoughts

Executive pay is often debated but treating it as a strategic tool helps meet shareholder expectations, motivate leaders, and maintain public trust. Effective packages combine benchmarking, performance linkage, feedback, and communication, representing commitment to responsible capitalism.

Boards should align executive compensation with strategy, engage stakeholders, and uphold ethical standards. Packages must:

- Reflect performance

- Encourage long-term value

- Be competitive yet justifiable

- Withstand scrutiny

In a transparent environment, boards must use informed judgment based on data, context, and principles to influence corporate culture and leadership integrity.